The Cisco® Visual Networking Index (VNI) Global Mobile Data Traffic Forecast Update is part of the comprehensive Cisco VNI Forecast, an ongoing initiative to track and forecast the impact of visual networking applications on global networks. This report presents some of the major global mobile data traffic projections and growth trends.

Executive Summary

The Mobile Network in 2016

Global mobile data traffic grew 63 percent in 2016. Global mobile data traffic reached 7.2 exabytes per month at the end of 2016, up from 4.4 exabytes per month at the end of 2015. (One exabyte is equivalent to one billion gigabytes, and one thousand petabytes.)

Mobile data traffic has grown 18-fold over the past 5 years. Mobile networks carried 400 petabytes per month in 2011.

Fourth-generation (4G) traffic accounted for 69% of mobile traffic in 2016. Although 4G connections represented only 26 percent of mobile connections in 2016, they already accounted for 69 percent of mobile data traffic, while 3G connections represented 33 percent of mobile connections and 24 percent of the traffic. In 2016, a 4G connection generated four times more traffic on average than a 3G connection.

Mobile offload exceeded cellular traffic by a significant margin in 2016. Sixty percent of total mobile data traffic was offloaded onto the fixed network through Wi-Fi or femtocell in 2016. In total, 10.7 exabytes of mobile data traffic were offloaded onto the fixed network each month.

Almost half a billion (429 million) mobile devices and connections were added in 2016. Smartphones accounted for most of that growth, followed by M2M modules. Global mobile devices and connections in 2016 grew to 8.0 billion, up from 7.6 billion in 2015.

Globally, smart devices represented 46 percent of the total mobile devices and connections in 2016; they accounted for 89 percent of the mobile data traffic. (For the purposes of this study, “smart devices” refers to mobile connections that have advanced multimedia/computing capabilities with a minimum of 3G connectivity.) In 2016, on an average, a smart device generated 13 times more traffic than a nonsmart device.

Mobile network (cellular) connection speeds grew more than 3-fold in 2016. Globally, the average mobile network downstream speed in 2016 was 6.8 Megabits per second (Mbps), up from 2.0 Mbps in 2015.

Mobile video traffic accounted for 60 percent of total mobile data traffic in 2016. Mobile video traffic now accounts for more than half of all mobile data traffic.

The top 1 percent of mobile data subscribers generated 6 percent of mobile data traffic, down from 8 percent in 2015 and 52 percent in 2010. According to a mobile data usage study conducted by Cisco, the top 20 percent of mobile users generated 56 percent of mobile data traffic, and the top 1 percent generated 6 percent.

Average smartphone usage grew 38 percent in 2016. The average amount of traffic per smartphone in 2016 was 1,614 MB per month, up from 1,169 MB per month in 2015.

Smartphones (including phablets) represented only 45 percent of total mobile devices and connections in 2016, but represented 81 percent of total mobile traffic. In 2016, the typical smartphone generated 48 times more mobile data traffic (1,614 MB per month) than the typical basic-feature cell phone (which generated only 33 MB per month of mobile data traffic).

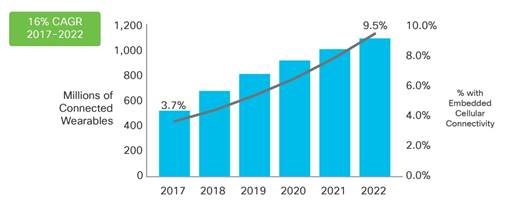

Globally, there were 325 million wearable devices (a sub-segment of the machine-to-machine [M2M] category) in 2016. Of these, 11 million wearables had embedded cellular connections.

Per-user iOS mobile devices (smartphones and tablets) data usage surpassed that of Android mobile devices data usage. By the end of 2016, average iOS consumption exceeded average Android consumption in North America and Western Europe, where iOS usage was 4.8 GB per month and Android was 3.2 GB per month.

In 2016, 43 percent of mobile devices were potentially IPv6-capable. This estimate is based on network connection speed and OS capability.

In 2016, the number of mobile-connected tablets increased 26% to 184 million, and the number of mobile-connected PCs increased 8% to 136 million. In 2016, the average mobile data traffic per PC/Tablet was 3,392 MB per month, compared to 1,614 MB per month per smartphone.

Average nonsmartphone usage increased to 33 MB per month in 2016, compared to 23 MB per month in 2015. Basic handsets still make up 47 percent of handsets on the network.

The Mobile Network Through 2021

Mobile data traffic will reach the following milestones within the next 5 years:

● Monthly global mobile data traffic will be 49 exabytes by 2021, and annual traffic will exceed half a zettabyte.

● Mobile will represent 20 percent of total IP traffic by 2021.

● The number of mobile-connected devices per capita will reach 1.5 by 2021.

● The average global mobile connection speed will surpass 20 Mbps by 2021.

● The total number of smartphones (including phablets) will be over 50 percent of global devices and connections by 2021.

● Smartphones will surpass four-fifths of mobile data traffic (86 percent) by 2021.

● 4G connections will have the highest share (53 percent) of total mobile connections by 2021.

● 4G traffic will be more than three-quarters of the total mobile traffic by 2021.

● More traffic was offloaded from cellular networks (on to Wi-Fi) than remained on cellular networks in 2016.

● Over three-fourths (78 percent) of the world’s mobile data traffic will be video by 2021.

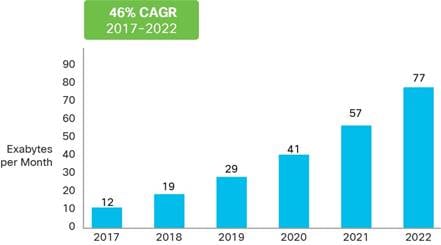

Global mobile data traffic will increase sevenfold between 2016 and 2021. Mobile data traffic will grow at a compound annual growth rate (CAGR) of 47 percent from 2016 to 2021, reaching 49.0 exabytes per month by 2021.

By 2021 there will be 1.5 mobile devices per capita. There will be 11.6 billion mobile-connected devices by 2021, including M2M modules—exceeding the world’s projected population at that time (7.8 billion).

Mobile network connection speeds will increase threefold by 2021. The average mobile network connection speed (6.8 Mbps in 2016) will reach 20.4 megabits per second (Mbps) by 2021.

By 2021, 4G will be 53 percent of connections, but 79 percent of total traffic. By 2021, a 4G connection will generate twice as much traffic on average as a 3G connection.

By 2021, 5G will be 0.2 percent of connections (25 million), but 1.5 percent of total traffic. By 2021, a 5G connection will generate 4.7 times more traffic than the average 4G connection.

By 2021, nearly three-quarters of all devices connected to the mobile network will be “smart” devices. Globally, 74.7 percent of mobile devices will be smart devices by 2021, up from 36.7 percent in 2016. The vast majority of mobile data traffic (98 percent) will originate from these smart devices by 2021, up from 89 percent in 2016.

By 2021, 73 percent of all global mobile devices could potentially be capable of connecting to an IPv6 mobile network. There will be 8.4 billion IPv6-capable devices by 2021.

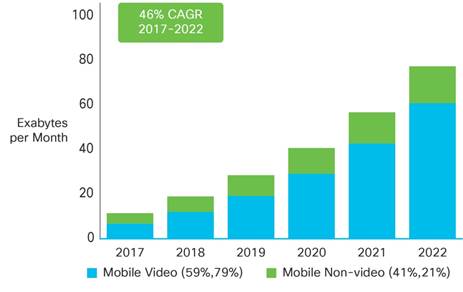

More than three-fourths of the world’s mobile data traffic will be video by 2021. Mobile video will increase 9-fold between 2016 and 2021, accounting for 78 percent of total mobile data traffic by the end of the forecast period.

By 2021, mobile-connected tablets and PCs will generate 8.0 GB of traffic per month, a doubling over the 2016 average of 3.4 GB per month. Aggregate traffic associated with PCs and tablets will be four times greater than it is today, with a CAGR of 33 percent.

The average smartphone will generate 6.8 GB of traffic per month by 2021, a fourfold increase over the 2016 average of 1.6 GB per month. By 2021, aggregate smartphone traffic will be seven times greater than it is today, with a CAGR of 48 percent.

By 2016, 63 percent of all traffic from mobile-connected devices (almost 84 exabytes) will be offloaded to the fixed network by means of Wi-Fi devices and femtocells each month. Of all IP traffic (fixed and mobile) in 2021, 50% will be Wi-Fi, 30% will be wired, and 20% will be mobile.

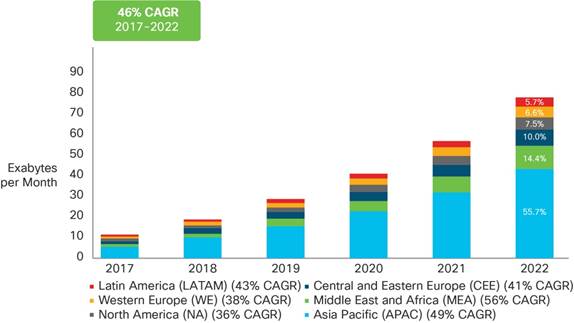

The Middle East and Africa will have the strongest mobile data traffic growth of any region with a 65 percent CAGR. This region will be followed by Asia Pacific at 49 percent and Latin America at 45 percent.

China’s mobile traffic will surpass that of the United States by the end of 2017. China’s mobile traffic will reach 1.9 exabytes per month by the end of 2017, and mobile traffic in the United States will reach 1.6 exabytes per month.

Appendix A summarizes the details and methodology of the VNI Mobile Forecast.

2016 Year in Review

Global mobile data traffic grew an estimated 63 percent in 2016. Growth rates varied widely by region, with Middle East and Africa having the highest growth rate (96 percent) followed by Asia Pacific (71 percent), Latin America (66 percent), and Central and Eastern Europe (64 percent). Western Europe grew at an estimated 52 percent, and North America trailed Western Europe at 44 percent growth in 2016 (refer to Figure 1). At the country level, Indonesia, China, and India led global growth at 142, 86, and 76 percent, respectively. These three countries also topped traffic growth in 2015, though in 2016 Indonesia’s traffic growth accelerated (versus 129 percent in 2015), and the traffic growth in China and India slowed relative to 2015 (when growth was 89 percent in India, and 111 percent in China). France, Korea, and Australia also experienced an acceleration in mobile traffic growth in 2016, while most other countries experienced strong but tapering growth compared with previous years.

Source: Cisco VNI Mobile, 2017

Global Mobile Data Traffic, 2016 to 2021

Overall mobile data traffic is expected to grow to 49 exabytes per month by 2021, a sevenfold increase over 2016. Mobile data traffic will grow at a CAGR of 47 percent from 2016 to 2021 (Figure 2).

Source: Cisco VNI Mobile, 2017

Asia Pacific will account for 47 percent of global mobile traffic by 2021, the largest share of traffic by any region by a substantial margin, as shown in Figure 3. North America, which had the second-largest traffic share in 2016, will have only the fourth-largest share by 2021, having been surpassed by Central and Eastern Europe and Middle East and Africa. Middle East and Africa will experience the highest CAGR of 65 percent, increasing 12-fold over the forecast period. Asia Pacific will have the second-highest CAGR of 49 percent, increasing 7-fold over the forecast period (Figure 3).

Source: Cisco VNI Mobile, 2017

Top Global Mobile Networking Trends

The sections that follow identify 7 major trends contributing to the growth of mobile data traffic.

1. Evolving toward Smarter Mobile Devices

2. Defining Cell Network Advances—2G, 3G, and 4G (Initial 5G Projections)

3. Measuring Mobile IoT Adoption—M2M and Emerging Wearables

4. Analyzing the Expanding Role and Coverage of Wi-Fi

5. Identifying New Mobile Applications and Requirements

6. Comparing Mobile Network Speed Improvements

7. Reviewing Tiered Pricing—Unlimited Data and Shared Plans

Trend 1: Evolving toward Smarter Mobile Devices

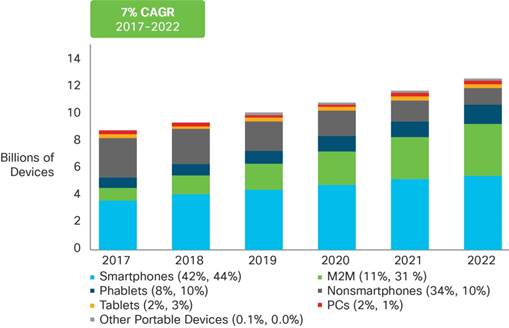

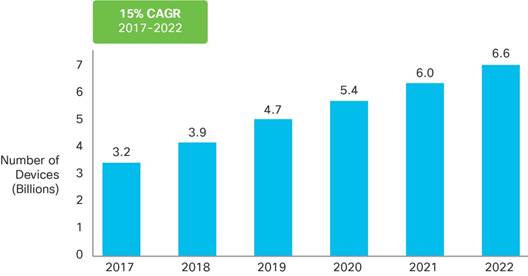

The ever changing mix and growth of wireless devices that are accessing mobile networks worldwide is one of the primary contributors to global mobile traffic growth. Each year severalnew devices in different form factors and increased capabilities and intelligence are introduced in the market. Last year we saw rise of phablets and more recently we see new form factors of laptops coming into the mix. More than 400 million (429 million) mobile devices and connections were added in 2016. In 2016, global mobile devices and connections grew to 8.0 billion, up from 7.6 billion in 2015. Globally, mobile devices and connections will grow to 11.6 billion by 2021 at a CAGR of 8 percent (Figure 4).

By 2021, there will be 8.3 billion handheld or personal mobile-ready devices and 3.3 billion M2M connections (e.g., GPS systems in cars, asset tracking systems in shipping and manufacturing sectors, or medical applications making patient records and health status more readily available, et al.). Regionally, North America and Western Europe are going to have the fastest growth in mobile devices and connections with 16 percent and 11 percent CAGR from 2016 to 2021, respectively.

Note: Figures in parentheses refer to 2016, 2021 device share.

Source: Cisco VNI Mobile, 2017

We see a rapid decline in the share of nonsmartphones from over 40 percent in 2016 (3.3 billion) to 13 percent by 2021 (1.5 billion). Another significant trend is the growth of smartphones (including phablets) from 45-percent share of total devices and connections in 2016 to over 50 percent (53 percent) by 2021.The most noticeable growth is going to occur in M2M connections, followed by tablets. M2M mobile connections will reach more than a quarter (29 percent) of total devices and connections by 2021. The M2M category is going to grow at 34-percent CAGR from 2016 to 2021, and tablets are going to grow at 15-percent CAGR during the same period. Along with the overall growth in the number of mobile devices and connections, there is clearly a visible shift in the device mix. This year we see a relative stabillzation in laptops but a further slowdown in the growth of tablets as new form factors of laptops get adopted and because of the new device category, phablets (included in our smartphone category), is gaining broader adoption.

From a traffic perspective, smartphones and phablets will continue to dominate mobile traffic (86 percent) while M2M category will continue to gain share by 2021 (refer to Figure 5).

Note: Figures in parentheses refer to 2016, 2021 device share.

Source: Cisco VNI Mobile, 2017

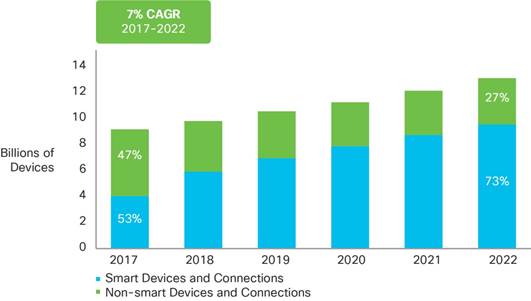

Throughout the forecast period, we see that the device mix is getting smarter with an increasing number of devices with higher computing resources, and network connection capabilities that create a growing demand for more capable and intelligent networks. We define smart devices and connections as those having advanced computing and multimedia capabilities with a minimum of 3G connectivity. The share of smart devices and connections as a percentage of the total will increase from 46 percent in 2016 to three-fourths, at 75 percent, by 2021, growing more than twofold during the forecast period (Figure 6).

Note: Percentages refer to device and connections share.

Source: Cisco VNI Mobile, 2017

Low-Power Wide-Area (LPWA) connections are included in our analysis. This wireless network connectivity is meant specifically for M2M modules that require low bandwidth and wide geographic coverage. Because these modules have very low bandwidth requirements and tolerate high latencies, we do not include them in the smart devices and connections category. For some regions, such as North America where the growth of LPWA is expected to be high, their inclusion in the mix would skew the percentage for smart devices and connections, so for regional comparison we have taken them out of the mix. Figure 7 provides a comparable global smart-to-nonsmart devices and connections split, excluding LPWA.

Note: Percentages refer to device and connections share.

Source: Cisco VNI Mobile, 2017

When we exclude LPWA M2M connections from the mix, the global percentage share of smart devices and connections is higher, at 82 percent by 2021.

Although this device mix conversion is a global phenomenon, some regions are ahead. By the end of 2021, North America will have 99 percent of its installed base converted to smart devices and connections, followed by Western Europe and Central and Eastern Europe with 92 percent smart devices and connections (Table 1).

Table 1. Regional Share of Smart Devices and Connections (Percent of the Regional Total)

|

Region |

2016 |

2021 |

|

North America |

81% |

99% |

|

Western Europe |

69% |

92% |

|

Central and Eastern Europe |

57% |

92% |

|

Asia Pacific |

46% |

81% |

|

Latin America |

44% |

80% |

|

Middle East and Africa |

19% |

71% |

Source: Cisco VNI Mobile, 2017

Figure 8 shows the impact of the growth of mobile smart devices and connections on global traffic. Globally, smart traffic is going to grow from 92 percent of the total global mobile traffic to 99 percent by 2021. This percentage is significantly higher than the ratio of smart devices and connections (75 percent by 2021), because on average a smart device generates much higher traffic than a nonsmart device. Globally, in 2016, a smart device generated 13 times more traffic than a nonsmart device, and by 2021 a smart device will generate nearly 21 times more traffic.

Note: Percentages refer to traffic share.

Source: Cisco VNI Mobile, 2017

IPv6

With the exponential proliferation of multiple smart devices becoming a reality, the need for each device having its own specific, unique address that it uses to communicate with other devices and the Internet and to define its location is becoming a necessity. IPv4 addresses, the current protocol devices use to communicate on the Internet, have almost exhausted the world over with just a few remaining at the African Internet Registry (AFRINIC). In addition to solving the IPv4 address depletion problem by providing more than enough addresses, the transition to the newer, better IPv6 protocol offers additional advantages where every device will have a globally routable public IP address on the Internet. Hence there is not just a need, but far more a necessity, to move to IPv6 with its 340 undecillion addresses that will make smart devices and the IoT a reality.

The transition to IPv6, which helps connect and manage the proliferation of newer-generation devices that are contributing to mobile network usage and data traffic growth, is well underway. Continuing the Cisco VNI focus on IPv6, the Cisco VNI 2016–2021 Mobile Data Traffic Forecast provides an update on IPv6-capable mobile devices and connections and the potential for IPv6 mobile data traffic.

Focusing on the high-growth mobile-device segments of smartphones and tablets, the forecast projects that globally 93 percent of smartphones and tablets (6.1 billion) will be IPv6-capable by 2021 (up from 68 percent, or 2.6 billion smartphones and tablets in 2016; refer to Figure 9). This estimation is based on OS support of IPv6 (primarily Android and iOS) and the accelerated move to higher-speed mobile networks (3.5G or higher) capable of enabling IPv6. (This forecast is intended as a projection of the number of IPv6-capable mobile devices, not mobile devices with an IPv6 connection actively configured by the Internet service provider [ISP].)

Source: Cisco VNI Mobile, 2017

For all mobile devices and connections, the forecasts project that, globally, 73 percent (8.4 billion) will be IPv6-capable by 2021, up from 43 percent (3.4 billion) in 2016 (refer to Figure 10). M2M emerges as a key segment of growth for IPv6-capable devices, reaching 1.8 billion by 2021, a growth at 37 percent CAGR during the forecast period. With its capability to vastly scale IP addresses and manage complex networks, IPv6 is critical in supporting the IoT of today and in the future. (Refer to Table 7 in Appendix C for more device detail.)

Regionally, Asia Pacific will lead throughout the forecast period with the highest number of IPv6-capable devices and connections, reaching 4.1 billion by 2021. Middle East and Africawill have the highest growth rates during the forecast period, at 32-percent CAGR. (Refer to Table 8 in Appendix C for more regional detail.)

Source: Cisco VNI Mobile, 2017

Considering the significant potential for mobile-device IPv6 connectivity, the Cisco VNI Mobile Forecast provides estimation for IPv6 network traffic based on a graduated percentage of IPv6-capable devices becoming actively connected to an IPv6 network. Looking to 2021, if approximately 60 percent of IPv6-capable devices are connected to an IPv6 network, the forecast estimates that, globally, IPv6 traffic will amount to 27.4 exabytes per month or 56 percent of total mobile data traffic, a 26-fold growth from 2016 to 2021 (Figure 11).

Source: Cisco VNI Mobile, 2017

Security is the top concern in every enterprise’s mind today and it is all the more important for IPv6 as compared to its predecessor (IPv4) given its vast addressable range.

IPSec is the most widely used protocol suite for security in any communication network and even in present day can be easily added to any IPv4 network. On the other hand, IPv6 includes native support for IPSec, which by itself may not be a big advantage, however when considered in combination with other capabilities, notably IPv6’s self-discovery capabilities and peer-to-peer nature, IPv6’s inherent support of IPSec plays an important role in creating networks that are both simple to set up and secure.

IPv6 with its vast addressable space makes any device supporting it more accessible at a global scale thus making the protocol more desirable for applications such as remote monitoring and support all the way from IT infrastructure to automobiles and appliances. Such capabilities also allow manufacturers to increase the life expectancy and functionalities of their products while decreasing the service costs.

IPv6 is also expected to give rise to entirely new applications that would either be difficult or impossible to deploy with IPv4. The multicast capabilities of IPv6, allowing one-to-many communications, may give rise to everything from new forms of games to social network applications.

Inherent support for IPSec within IPv6 makes it very easy to bring such new applications and benefits of IPv6 to life, something that may have been difficult or even impossible with IPv4.

However, given that IPv6 is still a network layer protocol it cannot prevent advanced security breaches on OSI layers that sit over the network layer.

For example:

● Application layer attacks: Attacks performed at the application layer (OSI Layer 7) such as buffer overflow, viruses and malicious codes, web application attacks, and so on.

● Brute -force password guessing attacks on authentication modules.

● Unauthorized devices introduced into the network.

● Denial of service attacks.

● Attacks using social networking techniques such as email spamming, phishing, etc.

For additional views on the latest IPv6 deployment trends, visit the Cisco site. The Cisco 6Lab analysis includes current statistics by country on IPv6 prefix deployment and IPv6 web-content availability, and estimations of IPv6 users. With the convergence of IPv6 device capability, content availability, and significant network deployment, the discussion of IPv6 has shifted focus from “what if” and “how soon will” to the “realization of the potential” that IPv6 has for service providers and end users alike.

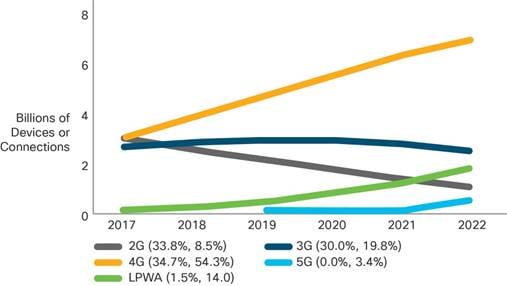

Trend 2: Defining Cell Network Advances—2G, 3G, and 4G (Initial 5G Projections)

Mobile devices and connections are not only getting smarter in their computing capabilities but are also evolving from lower-generation network connectivity (2G) to higher-generation network connectivity (3G, 3.5G, and 4G or LTE). This year, for the first time, we have also done projection of devices and connections with 5G connectivity. Combining device capabilities with faster, higher bandwidth and more intelligent networks leads to wide adoption of advanced multimedia applications that contribute to increased mobile and Wi-Fi traffic.

The explosion of mobile applications and phenomenal adoption of mobile connectivity by end users on the one hand and the need for optimized bandwidth management and network monetization on the other hand is fueling the growth of global 4G deployments and adoption, soon to be followed with 5G growth. Service providers around the world are busy rolling out 4G networks to help them meet the growing end-user demand for more bandwidth, higher security, and faster connectivity on the move (Appendix B). Many providers have also started field trials for 5G and are gearing towards rolling out 5G deployments towards the end of the forecast period.

Globally, the relative share of 3G- and 3.5G-capable devices and connections will surpass 2G-capable devices and connections by 2018. The other significant crossover will also occur in 2018, when 4G will surpass 3G as well as all other types of connection share. By 2021, 53 percent of all global devices and connections will be 4G-capable (Figure 12). By 2021, there will be less than a half percent (0.2%) devices and connections with 5G capability.

The global mobile 4G connections will grow from 2.1 billion in 2016 to 6.1 billion by 2021 at a CAGR of 24 percent. 5G connections will appear on the scene in 2020 and will grow more than a thousand percent from 2.3 million in 2020 to over 25 million in 2021. Since 5G connections share is so small we have combined it with 4G share and are hence labeling 4G as 4G+.

Note: Percentages refer to device and connections share.

Source: Cisco VNI Mobile, 2017

We are also including Low-Power Wide-Area (LPWA) connections in our analysis. This type of ultranarrowband wireless network connectivity is meant specifically for M2M modules that require low bandwidth and wide geographic coverage. It provides high coverage with low power consumption, module, and connectivity costs, thereby creating new M2M use cases for mobile network operators (MNOs) that cellular networks alone could not have addressed. Examples include utility meters in residential basements, gas or water meters that do not have power connection, street lights, and pet or personal asset trackers. The share of LPWA connections (all M2M) will grow from less than 1percent in 2016 to 8.9 percent by 2021, from 58 million in 2016 to over 1 billion by 2021.

The network evolution toward more advanced networks is happening both across the end-user device segment and within the M2M connections category, as shown in Figure 13 and Figure 14.

When the M2M category is excluded, the 4G growth becomes even more apparent, with 56-percent device share by 2021. 5G connections, excluding M2M, will also grow more than a thousand percent from 2.2 million in 2020 to over 24.5 million in 2021.

Note: Percentages refer to device share.

Source: Cisco VNI Mobile, 2017

M2M capabilities, similar to end-user mobile devices, are migrating toward more advanced networks (Figure 14). On one hand, we see 4G connections share growing to 46 percent by 2021, up from 23 percent in 2016, and we also see a big growth in LPWA from 7 percent in 2016 to 31 percent by 2021. Even though LPWA might not be bandwidth-heavy and can tolerate high latency, it is an overlay strategy for MNOs to expand their M2M reach.

Note: Percentages refer to M2M connections share.

Source: Cisco VNI Mobile, 2017

The transition from 2G to 3G or 4G deployment is a global phenomenon. In fact, by 2021, 65 percent of the mobile devices and connections in Western Europe as well as Central and Eastern Europe will have 4G+ capability, surpassing 3G-capable devices and connections. North America (63 percent) will have the second-highest ratio of 4G+ connections by 2021 (Appendix B). At the country level, China will have 86 percent of its total connections on 4G by 2021, followed by Australia having 75 percent of all its connections on 4G by 2021. By 2021, North America with 31 percent and Western Europe with 20 percent share will be the two regions with highest LPWA adoption. By 2021, North America will be the region with highest share of connections on 5G at 1 percent. The top three 5G countries in terms of percent of devices and connections share on 5G will be United States, Korea and Japan with more than 1 percent of their devices and connections being on 5G by 2021.

Although the growth in 4G, with its higher bandwidth, lower latency, and increased security, will help regions bridge the gap between their mobile and fixed network performance, deployment of LPWA networks will help enhance the reach of mobile providers in the M2M segment. This situation will lead to even higher adoption of mobile technologies by end users, making access to any content on any device from anywhere and the Internet of Everything (IoT) more sustainable.

5G is the next phase of mobile technology. 5G’s primary improvements over 4G include high bandwidth (greater than 1 Gbps), broader coverage, and ultra-low latency. Whereas 4G has been driven by device proliferation and dynamic information access, 5G will be driven largely by IoT applications. With 5G, resources (channels) will be allocated based on awareness of content, user, and location. This technology is expected to solve frequency licensing and spectrum management problems. Currently, there are field trials being carried out by some operators, however, significant 5G deployments are not expected until 2021 and beyond. There are several gating factors such as approval of regulatory standards, spectrum availability and auctioning and return-on-investment (ROI) strategies to justify the investment associated with new infrastructure transitions and deployments.

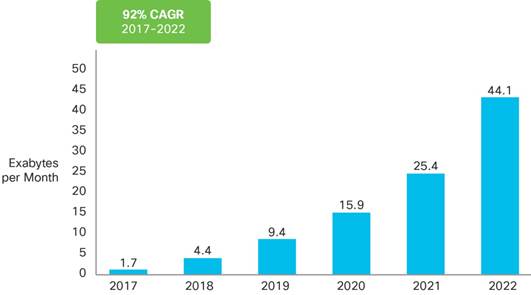

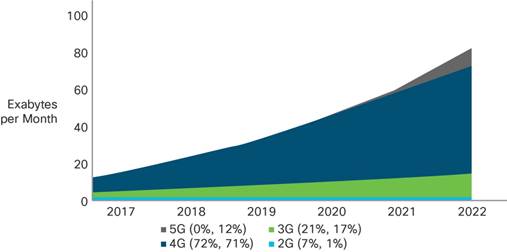

Traffic Impact of 4G and 5G

In 2016, 4G already carried 69 percent of the total mobile traffic and represented the largest share of mobile data traffic by network type. It will continue to grow faster than other networks to represent 79 percent of all mobile data traffic by 2021 (Figure 15). By 2021, 5G will support 1.5 percent of mobile traffic. 5G connectivity with its very high bandwidth (100 Mbps) and ultra low latency (1 millisecond) is expected to drive very high traffic volumes.

Currently, a 4G connection generates nearly four times more traffic than a 3G connection. There are two reasons for the higher usage per device on 4G. The first is that many 4G connections today are for high-end devices, which have a higher average usage. The second is that higher speeds encourage the adoption and usage of high- bandwidth applications, such that a smartphone on a 4G network is likely to generate significantly more traffic than the same model smartphone on a 3G or 3.5G network. By 2021 a 4G connection will still generate two times more traffic than a 3G connection.

Note: By 2021, 5G will account for 1.5% of global mobile traffic and 2G will account for 0.6%.

Source: Cisco VNI Mobile, 2017

Trend 3: Measuring Mobile IoT Adoption—M2M and Emerging Wearables

The phenomenal growth in smarter end-user devices and M2M connections is a clear indicator of the growth of IoT, which is bringing together people, processes, data, and things to make networked connections more relevant and valuable. This section focuses on the continued growth of M2M connections and the emerging trend of wearable devices. Both M2M and wearable devices are making computing and connectivity very pervasive in our day-to-day lives.

M2M connections—such as home and office security and automation, smart metering and utilities, maintenance, building automation, automotive, healthcare and consumer electronics, and more—are being used across a broad spectrum of industries, as well as in the consumer segment. As real-time information monitoring helps companies deploy new video-based security systems, while also helping hospitals and healthcare professionals remotely monitor the progress of their patients, bandwidth-intensive M2M connections are becoming more prevalent. Globally, M2M connections will grow from 780 million in 2016 to 3.3 billion by 2021, a 34-percent CAGR—a fourfold growth. As discussed in the previous trend, M2M capabilities similar to end-user mobile devices are experiencing an evolution from 2G to 3G and 4G and higher technologies (Figure 16).

Note: In 2016, LPWA accounts for 7% of global mobile M2M connections.

Source: Cisco VNI Mobile, 2017

An important factor contributing to the growing adoption of IoT is the emergence of wearable devices, a category with high growth potential. Wearable devices, as the name suggests, are devices that can be worn on a person and have the capability to connect and communicate to the network either directly through embedded cellular connectivity or through another device (primarily a smartphone) using Wi-Fi, Bluetooth, or another technology.

These devices come in various shapes and forms, ranging from smart watches, smart glasses, heads-up displays (HUDs), health and fitness trackers, health monitors, wearable scanners and navigation devices, smart clothing, etc. The growth in these devices has been fueled by enhancements in technology that have supported compression of computing and other electronics (making the devices light enough to be worn). These advances are being combined with fashion to match personal styles, especially in the consumer electronics segment, along with network improvements and the growth of applications, such as location-based services, virtual reality (VR) and augmented reality (AR). Although there have been vast technological improvements to make wearables possible as a significant device category, wide-scale availability of embedded cellular connectivity still has some barriers to overcome for some applications—such as technology limitations, regulatory constraints, and health concerns.

By 2021, we estimate that there will be 929 million wearable devices globally, growing nearly threefold from 325 million in 2016 at a CAGR of 23 percent (Figure 17). As mentioned earlier, there will be limited embedded cellular connectivity in wearables through the forecast period. Only 7 percent will have embedded cellular connectivity by 2021, up from 3 percent in 2016. Currently, wearables are included within our M2M forecast.

Source: Cisco VNI Mobile, 2017

Regionally, North America will have the largest regional share of wearables, with 41-percent share in 2021 up from 39-percent share in 2016 (Appendix B). Other regions with significant share include Asia Pacific with 31-percent share in 2016, declining to 28 percent by 2021.

Applications as virtual reality are also adding to the adoption of wearables such as headsets. VR headsets are going to grow from 18 million in 2016 to nearly 100 million by 2021, a fivefold growth. More than half of these will be connected to smartphones by 2021. The remaining VR headsets will be connected to PCs, consoles and a few will be standalone. (Figure18).

The wearables category will have a tangible impact on mobile traffic, because even without embedded cellular connectivity wearables can connect to mobile networks through smartphones. With high bandwidth applications such as virtual reality taking off the traffic impact might become even greater.

Source: IHS, Cisco VNI Mobile, 2017

Trend 4: Analyzing the Expanding Role and Coverage of Wi-Fi

Offload

Much mobile data activity takes place within users’ homes. For users with fixed broadband and Wi-Fi access points at home, or for users served by operator-owned femtocells and picocells, a sizable proportion of traffic generated by mobile and portable devices is offloaded from the mobile network onto the fixed network. For the purposes of this study, offload pertains to traffic from dual-mode devices (i.e., supports cellular and Wi-Fi connectivity, excluding laptops) over Wi-Fi and small-cell networks. Offloading occurs at the user or device level when one switches from a cellular connection to Wi-Fi or small-cell access. Our mobile offload projections include traffic from both public hotspots and residential Wi-Fi networks.

As a percentage of total mobile data traffic from all mobile-connected devices, mobile offload increases from 60 percent (10.7 exabytes/month) in 2016 to 63 percent (83.6 exabytes/month) by 2021 (Figure 19). Offload volume is determined by smartphone penetration, dual-mode share of handsets, percentage of home-based mobile Internet use, and percentage of dual-mode smartphone owners with Wi-Fi fixed Internet access at home.

Note: Offload pertains to traffic from dual-mode devices (excluding laptops) over Wi-Fi or small-cell networks.

Source: Cisco VNI Mobile, 2017

The amount of traffic offloaded from smartphones will be 64 percent by 2021, and the amount of traffic offloaded from tablets will be 72 percent.

Some have speculated that Wi-Fi offload will be less relevant after 4G networks are in place because of the faster speeds and more abundant bandwidth. However, 4G networks have attracted high-usage devices such as advanced smartphones and tablets, and now 4G plans are subject to data caps similar to 3G plans.

For these reasons, Wi-Fi offload is higher on 4G networks than on lower-speed networks, now and in the future according to our projections. The amount of traffic offloaded from 4G was 63 percent at the end of 2016, and it will be 66 percent by 2021 (Figure 20). The amount of traffic offloaded from 3G will be 55 percent by 2021, and the amount of traffic offloaded from 2G will be 69 percent. As 5G is being introduced, plans will be generous with data caps and speeds will be high enough to encourage traffic to stay on the mobile network instead of being offloaded, so the offload percentage will be less than 50 percent. As the 5G network matures, we may see higher offload rates.

Note: Offload pertains to traffic from dual-mode devices (excluding laptops) over Wi-Fi or small-cell networks.

Source: Cisco VNI Mobile, 2017

Growth of Wi-Fi Hotspots

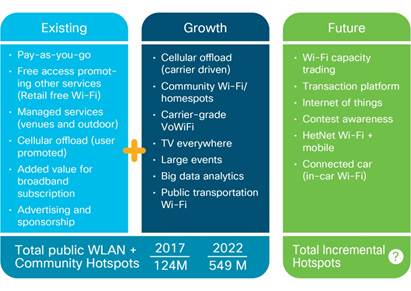

Globally, total public Wi-Fi hotspots (including homespots) will grow six-fold from 2016 to 2021, from 94.0 million in 2016 to 541.6 million by 2021 (Figure 21). Total Wi-Fi homespots will grow from 85.1 million in 2016 to 526.2 million by 2021. Homespots or community hotspots are a significant part of the public Wi-Fi strategy. The public Wi-Fi hotspots include public Wi-Fi commercial hotspots and homespots.

Source: Maravedis, Cisco VNI Mobile, 2017

Commercial hotspots include fixed and MNO hotspots that are purchased or installed for a monthly fee or commission. Commercial hotspots can be set up to offer both fee-based and free Internet Wi-Fi access. Hotspots are installed to offer public Wi-Fi at cafés and restaurants, retail chains, hotels, airports, planes, and trains for customers and guests. Cafés, retail shops, public venues, and offices usually provide a free Wi-Fi Service Set Identifier (SSID) for their guests and visitors. Commercial hotspots are a smaller subset of the overall public Wi-Fi hotspot forecast and will grow from 8.8 Million in 2016 to 15.3 Million by 2021.

Homespots or community hotspots have emerged as a potentially significant element of the public Wi-Fi landscape. In this model, subscribers allow part of the capacity of their residential gateway to be open to casual use. Homespots have dual SSIDs and operators download software to a subscriber’s home gateway, allowing outside users to use one of the SSIDs like a hotspot. This model is used to facilitate guest Wi-Fi and mobile offload, as well as other emerging models of community use of Wi-Fi (Figure 22).

Note: *Middle East and Africa represents 1 percent of global public Wi-Fi hotspots by 2021.

Source: Maravedis, Cisco VNI Mobile, 2017

Wi-Fi access has had widespread acceptance by MNOs globally, and it has evolved as a complementary network for traffic offload purposes—offloading from expensive cellular networks on to lower-cost-per-bit Wi-Fi networks. If we draw a parallel from data to voice, we can foresee a similar evolution where VoWiFi is evolving as a supplement to cellular voice, extending the coverage of cellular networks through Wi-Fi for voice within the buildings and other areas that have a wider and more optimum access to Wi-Fi hotspots.

Overall Wi-Fi Traffic Growth

A broader view of Wi-Fi traffic (inclusive of traffic from Wi-Fi-only devices) shows that Wi-Fi and mobile are both growing faster than fixed traffic (traffic from devices connected to the network through Ethernet). Fixed traffic will fall from 52 percent of total IP traffic in 2015 to 33 percent by 2020. Mobile and offload from mobile devices together will account for 47 percent of total IP traffic by 2020, a testament to the significant growth and impact of mobile devices and lifestyles on overall traffic. Wi-Fi traffic from both mobile devices and Wi-Fi-only devices together will account for almost half (49 percent) of total IP traffic by 2020, up from 42 percent in 2015 (Figure 23).

(Note that this forecast extends only to 2020 because the fixed forecast has not yet been extended to include 2021.)

Note: Fixed/Wi-Fi from Mobile Devices may include a small amount of Fixed/Wired from Mobile Devices

Source: Cisco VNI Mobile, 2017

Trend 5: Identifying New Mobile Applications and Requirements

Because mobile video content has much higher bit rates than other mobile content types, mobile video will generate much of the mobile traffic growth through 2021. Mobile video will grow at a CAGR of 54 percent between 2016 and 2021, higher than the overall average mobile traffic CAGR of 47 percent. Of the 49 exabytes per month crossing the mobile network by 2021, 38 exabytes will be due to video (Figure 24). Mobile video represented more than half of global mobile data traffic beginning in 2012.

Note: Figures in parentheses refer to 2016 and 2021 traffic share.

Source: Cisco VNI Mobile, 2017

One consequence of the growth of video in both fixed and mobile contexts is the resulting acceleration of busy- hour traffic in relation to average traffic growth. Video usage tends to occur during evening hours and has a “prime time,” unlike general web usage that occurs throughout the day. As a result, more video usage means more traffic during the peak hours of the day.

Virtual Reality (VR) and Augmented Reality (AR)

Virtual reality immerses users in a simulated environment and augmented reality is an overlay of technology on the real world. Both are equally appealing to a creative mind and have their own set of specific applications.

Both VR and AR are poised to be the next set of the biggest trends in mobile technology. The evolution of edge computing and advancements in wireless networking ranging from the imminent roll out of 5G to highly efficient mobile connectivity solutions coupled with access to smarter mobile and wearable devices have all contributed to providing a rich environment for the proliferation and growth of AR and VR.

The accelerated acquisition of smartphones, tablets and wearable devices is significantly contributing to the development of AR and VR markets. Globally, smartphones will be 53.1% of device connections by 2021 (CAGR of 11 percent), and 85.8% of total traffic growing at a CAGR of 48 percent. VR headsets will grow from an installed base of 18 million in 2016 to nearly a 100 million by 2021, a growth of 40 percent CAGR. AR and VR market development is expected to follow a similar trend.

Table 2. Key accelerators and barriers to entry for AR and VR market

|

|

Adoption Accelerators |

Key Inhibitors and Dependencies |

|

VR and AR |

● Investment from sports, gaming and entertainment industry

● Ease of access to consumers through fast and efficient networks and new smart devices

● Development of software components and proliferation of different VR and AR platforms

● Accelerating adoption of VR by early adopters in the gaming industry

● Vast applicability of AR in many different industry segments

|

● Lack of rich content

● Short battery life

● Dependency on the impending roll out of 5G

● Dependency on rollout of IoT or Tactile Internet

|

Source: Cisco VNI Mobile, 2017

While gaming is one of the key applications driving VR, AR is primarily been driven by industrial applications such as retail, medicine, education, tourism, retail shopping (furniture, clothes comparison, etc.) – just to name a few. In comparison to VR, currently AR seems to be growing at a slower rate but with its multiple applications in different industries it stands a chance to become more popular than VR. But the jury is still out as things have just started evolving in this fascinating space.

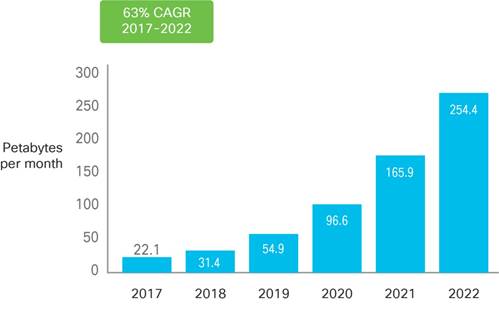

All these innovations in AR and VR will place new demands on the network in terms of its quality and performance. Bandwidth and latency requirements will become increasingly imperative for a high quality VR and AR experience and Service Providers will need to take a note of this new demand. Globally, Virtual Reality traffic will grow 11 fold from 13.3 Petabytes per month in 2016, to 140 Petabytes per month in 2021. (See Figure 26).

Source: Cisco VNI Mobile, 2017

Globally, Augmented Reality traffic will increase 7-fold between 2016 and 2021, from 3 Petabytes per month in 2016 to 21 Petabytes per month in 2021. (See Figure 27).

Source: Cisco VNI Mobile, 2017

This is a tremendous opportunity for service providers to jump in at and provide their distribution and GTM (Go to market) muscle to further drive the adoption of VR and AR. VR and AR ecosystems are just forming now, Service providers can catch some of these early developments and gain significantly by owning or helping develop some of the AR and VR ecosystems that will ultimately drive their network connectivity offerings. Whether AR trumps VR or VR grows faster than AR remains to be seen- what is unmistakable is that there will be a resounding impact with this new technological advance.

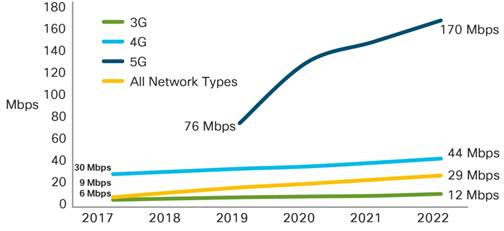

Trend 6: Comparing Mobile Network Speed Improvements

Globally, the average mobile network connection speed in 2016 was 6.8 Mbps. The average speed will grow at a CAGR of 24.4 percent, and will reach nearly 20.4 Mbps by 2021. Smartphone speeds, generally 3G and higher, will be on par with the overall average mobile connection by 2021. Smartphone speeds will nearly double by 2021, reaching 20.3 Mbps.

Anecdotal evidence supports the idea that usage increases when speed increases, although there is often a delay between the increase in speed and the increased usage, which can range from a few months to several years. However, in mature markets with strong data caps implementation, evidence points to the fact that the increase in speed may not lead to the increase in usage of mobile data. The Cisco VNI Mobile Forecast relates application bit rates to the average speeds in each country. Many of the trends in the resulting traffic forecast can be seen in the speed forecast, such as the high growth rates for developing countries and regions relative to more developed areas (Table 3).

Table 3. Global and Regional Projected Average Mobile Network Connection Speeds (in Mbps)

|

|

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

CAGR 2016–2021 |

|

Global |

|||||||

|

Global speed: All handsets |

6.8 |

8.7 |

11.1 |

14.3 |

17.7 |

20.4 |

24% |

|

Global speed: Smartphones |

12.1 |

13.5 |

14.9 |

16.2 |

18.1 |

20.3 |

11% |

|

Global speed: Tablets |

19.1 |

22.6 |

24.5 |

26.2 |

27.2 |

27.8 |

8% |

|

By Region |

|||||||

|

Asia Pacific |

9.8 |

10.6 |

12.9 |

16.0 |

18.8 |

20.4 |

16% |

|

Latin America |

3.8 |

4.9 |

6.4 |

7.9 |

10.0 |

12.4 |

27% |

|

North America |

13.7 |

16.3 |

17.6 |

19.8 |

22.8 |

25.2 |

13% |

|

Western Europe |

11.4 |

16.0 |

18.6 |

21.6 |

25.7 |

28.5 |

20% |

|

Central and Eastern Europe |

6.3 |

10.1 |

12.3 |

13.6 |

16.2 |

18.4 |

24% |

|

Middle East and Africa |

3.8 |

4.4 |

5.3 |

6.8 |

8.5 |

10.8 |

23% |

Note: Current and historical speeds are based on data from Ookla’s Speedtest. Forward projections for mobile data speeds are based on third-party forecasts for the relative proportions of 2G, 3G, 3.5G, and 4G among mobile connections through 2021.

Source: Cisco VNI Mobile, 2017

The speed at which data can travel to and from a mobile device can be affected in two places: the infrastructure speed capability outside the device and the connectivity speed from the network capability inside the device (Figure 28).

These speeds are actual and modeled end-user speeds and not theoretical speeds that the devices, connection, or technology is capable of providing. Several variables affect the performance of a mobile connection: rollout of 2G, 3G, and 4G in various countries and regions, technology used by the cell towers, spectrum availability, terrain, signal strength, and number of devices sharing a cell tower. The type of application the end user uses is also an important factor.

Download speed, upload speed, and latency characteristics vary widely depending on the type of application, be it video, radio, or instant messaging.

Source: Cisco VNI Mobile, 2017

By 2021, 4G speeds will be nearly double than that of an average mobile connection. In comparison, an average mobile connection will surpass by 2-fold over 3G speeds by 2021 (Figure 29).

Source: Cisco VNI Mobile, 2017; Ookla Speedtest.net

Trend 7: Reviewing Tiered Pricing—Unlimited Data and Shared Plans

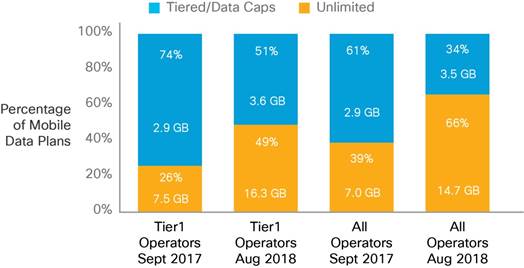

An increasing number of service providers worldwide are moving from unlimited data plans to tiered mobile data packages. To make an estimate of the impact of tiered pricing on traffic growth, we repeated a case study based on the data of several tier 1 and tier 2 North American service providers. The study tracks data usage from the timeframe of the introduction of tiered pricing 6 years ago. The findings in this study are based on Cisco’s analysis of data provided by a third-party data-analysis firm. This firm maintains a panel of volunteer participants who have given the company access to their mobile service bills, including GB of data usage. The data in this study reflects usage associated with devices (from January 2010 and September 2016) and also refers to the study from the previous update for longer-term trends. The overall study spans 6 years. Cisco’s analysis of the data consists of categorizing the pricing plans, operating systems, devices, and data usage by users; incorporating additional third-party information about device characteristics; and performing exploratory and statistical data analysis. The results of the study represent actual data from a few tier 1 and tier 2 mobile data operators from North American markets, global forecasts that include emerging markets and more providers may lead to lower estimates.

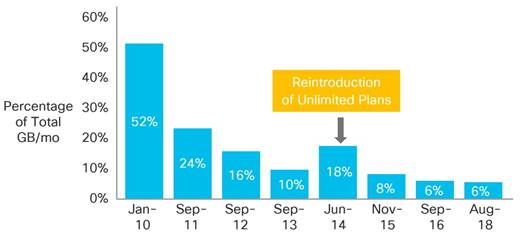

Unlimited plans had made a temporary resurgence from October 2013 to June 2014 with the increased number of unlimited plan offerings by tier 2 operators. In September 2016, 61 percent of the data plans were tiered and 39 percent of the data plans were unlimited. The gigabyte consumption of both tiered and unlimited plans has increased. On an average, usage on a device with a tiered plan grew from 1.1 GB in June 2014 to 2.9 GB in September 2016. Unlimited plans consumption grew at a faster rate, from 2.6 GB in June 2014 to 7.0 GB in September 2016.Tiered pricing plans are often designed to constrain the heaviest mobile data users, especially the top 1 percent of mobile data consumers.

The usage per month of the average top 1 percent of mobile data users has been steadily decreasing compared to that of overall usage. At the beginning of the 6-year study, 52 percent of the traffic was generated by the top 1 percent. With the reintroductions and promotions of unlimited plans by tier 2 operators in the study, the top 1 percent generated 18 percent of the overall traffic per month by June 2014. By September 2016, just 6 percent of the traffic was generated by the top 1 percent of users (Figure 30).

Source: Cisco VNI Mobile, 2017

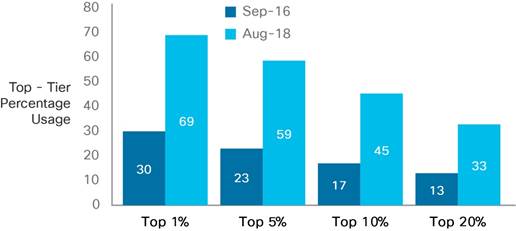

The top 20 percent of mobile users generate 56 percent of mobile data traffic and the top 5 percent of users consume 25 percent of mobile data traffic in the study (Figure 31).

Source: Cisco VNI Mobile, 2017

With the introduction of new, larger-screen smartphones and tablets with all mobile-data-plan types, there is a continuing increase in usage in terms of gigabytes per month per user in all the top tiers (Figure 32).

Note: Study based on North American Tier 1 and Tier 2 operators.

Source: Cisco VNI Mobile, 2017

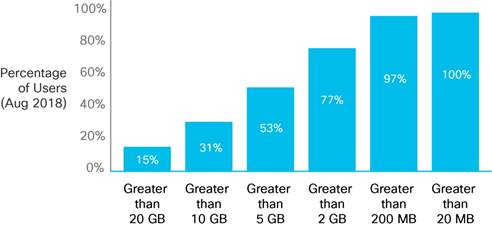

The proportion of mobile users who generated more than 2 gigabytes per month was 65 percent of users at the by September 2016, and 10 percent of the users consumed more than 10 gigabytes per month of mobile data (Figure 33) in the study.

Note: Study based on North American Tier 1 and Tier 2 operators.

Source: Cisco VNI Mobile, 2017

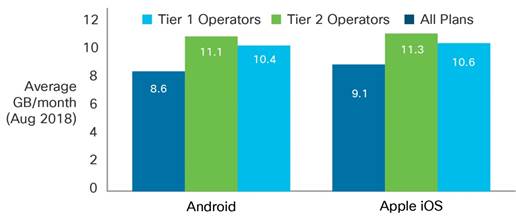

iOS Marginally Surpasses Android in Data Usage

At the beginning of the 6-year tiered-pricing case study, Android data consumption was equal to, if not higher than, that of other smartphone platforms. However, Apple-based devices have since caught up, and their data consumption is marginally higher than that of Android devices in terms of gigabytes per month per connection usage (Figure 34).

Note: Study based on North American Tier 1 and Tier 2 operators.

Source: Cisco VNI Mobile, 2017

Tiered plans outnumber unlimited plans; unlimited plans continue to lead in data consumption. Although the number of unlimited plans with tier 1 operators is declining, users with tier 1 operators have a higher average usage in gigabytes/month with unlimited plans (Figure 35).

Note: Study based on to North American Tier 1 and Tier 2 operators.

Source: Cisco VNI Mobile, 2017

The number of shared plans is now a majority compared to that of regular plans. The average data usage for shared plans is approaching that of regular plans (Figure 36).

Note: Study based on to North American Tier 1 and Tier 2 operators.

Source: Cisco VNI Mobile, 2017

Besides mainstream mobile devices, billions of IoT connections will be added over next 5 years. These connections are predominantly either on Wi-Fi and/or on cellular networks. In Figure 36 is the consumption of a small selection of popular IoT devices and their consumption in Megabytes (MB) per hour on the Wi-Fi network at the end of 2016. If these connections were on the mobile network and on a 5 GB data cap, the following Figure 37 shows the number of hours of consumption these IoT connections would take to fill the data cap. There are immense implications on the network design and readiness for the slew of IoT devices coming on to the network, be it Wi-Fi or mobile. Mobile data plans will need to evolve to accommodate the large mix and types of connections for end consumers and subscribers.

Note: *530 MB per hour upload

Source: Nielsen Mobile 2016; Cisco VNI Mobile, 2017

Conclusion

Mobile connectivity has become essential for many network users. Most people already consider mobile voice service a necessity, and mobile voice, data, and video services are fast becoming an integral part of consumers and business users’ lives. Used extensively by consumer as well as enterprise segments, with impressive uptakes in both developed and emerging markets, mobility has proved to be transformational. The number of mobile subscribers has grown rapidly, and bandwidth demand for data and video content continues to increase. Mobile M2M connections represent the fastest growing device/connection category in our forecast. The next 5 years are projected to provide unabated mobile video adoption. Backhaul capacity and efficiency must increase so mobile broadband, data access, and video services can effectively support consumer usage trends and keep mobile infrastructure costs in check.

We continue to see evolution of mobile networks. While 4G or LTE connectivity is forecasted to have the primary share of the market, there are field trails currently underway for 5G in some countries. Deploying next-generation mobile networks requires greater service portability and interoperability. With the proliferation of mobile and portable devices, there is an imminent need for networks to allow all these devices to be connected transparently, with the network providing high-performance computing and delivering enhanced real-time video and multimedia. New network capabilities have generated uptake of newer advanced mobile services such as augmented reality and virtual reality. We find that this continuous evolution towards enhanced bandwidth, latency, security and openness of mobile networks will broaden the range of applications and services that can be deployed, creating a highly enhanced mobile broadband experience. The expansion of wireless access (both cellular and Wi-Fi) will increase the number of consumers who can access and subsequently rely on mobile networks, creating a need for greater economies of scale and lower cost per bit.

As many business models emerge with new forms of advertising; media and content partnerships; and mobile services including M2M, live gaming, and augmented and virtual reality, a mutually beneficial situation needs to be developed for service providers and over-the-top providers. New partnerships, ecosystems, and strategic consolidations are expected to further transform the wireless networking landscape as mobile operators, content providers, application developers, and others seek to monetize the content, services, and communications that traverse mobile networks. Operators must solve the challenge of effectively monetizing video traffic while developing profitable business cases that support capital infrastructure expenditures needed for 5G. They must become more agile and able to change course quickly and provide innovative services to engage and retain a wide range of customers from technology savvy to technology agnostic. While the net neutrality regulatory process and business models of operators evolve, there is an unmet demand from consumers for the highest quality and speeds. There is a definite move towards wireless technologies becoming seamless with wired networks for ubiquitous connectivity and experiences. The next few years will be critical for operators and service providers to plan future network deployments that will create an adaptable environment in which the multitude of mobile-enabled devices and applications of the future can be deployed.

For More Information

Inquiries can be directed to traffic-inquiries@cisco.com.

Appendix A: The Cisco VNI Global Mobile Data Traffic Forecast

Table 4 shows detailed data from the Cisco VNI Global Mobile Data Traffic Forecast. This forecast includes only cellular traffic and excludes traffic offloaded onto Wi-Fi and small cell from dual-mode devices. The “other portable devices” category includes readers, portable gaming consoles, and other portable devices with embedded cellular connectivity. Wearables are included in the “M2M” category.

Table 4. Global Mobile Data Traffic, 2016–2021

|

|

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

CAGR 2016–2021 |

|

By Application Category (TB per Month) |

|||||||

|

Web, data, and VoIP |

2,153,676 |

2,938,884 |

3,779,988 |

4,674,801 |

5,538,615 |

6,434,681 |

24% |

|

Video |

4,375,000 |

7,225,123 |

11,415,329 |

17,564,661 |

26,067,686 |

38,148,326 |

54% |

|

Audio streaming |

559,999 |

843,394 |

1,193,711 |

1,620,662 |

2,103,876 |

2,674,183 |

37% |

|

File sharing |

151,874 |

258,617 |

403,273 |

592,352 |

820,954 |

1,102,867 |

49% |

|

By Device Type (TB per Month) |

|||||||

|

Nonsmartphones |

109,505 |

137,852 |

169,955 |

199,173 |

236,257 |

269,189 |

20% |

|

Smartphones |

5,887,078 |

9,328,403 |

14,076,023 |

20,710,278 |

29,484,004 |

42,017,358 |

48% |

|

Tablets and PCs |

1,085,059 |

1,514,749 |

2,040,640 |

2,681,672 |

3,457,800 |

4,439,720 |

33% |

|

M2M |

157,998 |

284,415 |

505,292 |

861,025 |

1,409,949 |

2,224,543 |

70% |

|

Other portable devices |

910 |

599 |

391 |

328 |

432 |

659 |

-6% |

|

By Region (TB per Month) |

|||||||

|

North America |

1,411,021 |

2,000,301 |

2,776,564 |

3,753,177 |

4,838,494 |

6,397,092 |

35% |

|

Western Europe |

736,377 |

1,084,396 |

1,534,120 |

2,167,831 |

3,019,843 |

4,189,615 |

42% |

|

Asia Pacific |

3,109,117 |

4,900,007 |

7,434,743 |

11,048,030 |

15,911,056 |

22,845,908 |

49% |

|

Latin America |

449,944 |

688,890 |

1,023,408 |

1,475,498 |

2,078,670 |

2,898,651 |

45% |

|

Central and Eastern Europe |

923,803 |

1,396,079 |

2,013,989 |

2,836,076 |

3,886,561 |

5,252,334 |

42% |

|

Middle East and Africa |

610,286 |

1,196,346 |

2,009,476 |

3,171,864 |

4,853,817 |

7,367,869 |

65% |

|

Total (TB per Month) |

|||||||

|

Total Mobile Data Traffic |

7,240,550 |

11,266,018 |

16,792,300 |

24,452,476 |

34,588,442 |

48,951,469 |

47% |

Source: Cisco Mobile VNI, 2017

The Cisco VNI Global Mobile Data Traffic Forecast relies in part upon data published by Ovum, Machina, Strategy Analytics, Infonetics, Gartner, IDC, Dell’Oro, Synergy, ACG Research, Nielsen, comScore, Verto Analytics, the International Telecommunications Union (ITU), CTIA, and telecommunications regulators in each of the countries covered by VNI.

The Cisco VNI methodology begins with the number and growth of connections and devices, applies adoption rates for applications, and then multiplies the application user base by Cisco’s estimated minutes of use and KB per minute for that application. The methodology has evolved to link assumptions more closely with fundamental factors, to use data sources unique to Cisco, and to provide a high degree of application, segment, geographic, and device specificity.

● Inclusion of fundamental factors: As with the fixed IP traffic forecast, each Cisco VNI Global Mobile Data Traffic Forecast update increases the linkages between the main assumptions and fundamental factors such as available connection speed, pricing of connections and devices, computational processing power, screen size and resolution, and even device battery life. This update focuses on the relationship of mobile connection speeds and the KB-per-minute assumptions in the forecast model.

● Device-centric approach: As the number and variety of devices on the mobile network continue to increase, it becomes essential to model traffic at the device level rather than the connection level. This Cisco VNI Global Mobile Data Traffic Forecast update details traffic to smartphones; nonsmartphones; laptops, tablets, and netbooks; e-readers; digital still cameras; digital video cameras; digital photo frames; in-car entertainment systems; and handheld gaming consoles.

● Estimation of the impact of traffic offload: The Cisco VNI Global Mobile Data Traffic Forecast model now quantifies the effect of dual-mode devices and femtocells on handset traffic. Data from the USC Institute for Communication Technology Management’s annual mobile survey was used to model offload effects.

Appendix B: Global 4G Networks and Connections

Tables 5 and 6 show the growth of regional 4G+ connections and wearable devices, respectively.

Table 5. Regional 4G+ Connections Growth

|

|

2016 |

2021 |

||

|

|

Number of 4G+ Connections (M) |

Percent of Total Connections |

Number of 4G+ Connections (M) |

% of Total |

|

Asia Pacific |

1,223 |

30% |

3,199 |

56% |

|

Central and Eastern Europe |

114 |

17% |

579 |

65% |

|

Latin America |

119 |

16% |

536 |

55% |

|

Middle East and Africa |

74 |

6% |

411 |

23% |

|

North America |

321 |

62% |

687 |

63% |

|

Western Europe |

221 |

34% |

731 |

65% |

|

Global |

2,072 |

26% |

6,143 |

53% |

Source: Cisco Mobile VNI, 2017

Table 6. Regional Wearable Devices Growth

|

|

2016 |

2021 |

||

|

|

Number of Wearable Devices (M) |

Percent of Global |

Number of Wearable Devices (M) |

Percent of Global |

|

Asia Pacific |

99.8 |

31% |

258.2 |

28% |

|

Central and Eastern Europe |

17.5 |

5% |

55.6 |

6% |

|

Latin America |

12.6 |

4% |

39.0 |

4% |

|

Middle East and Africa |

14.0 |

4% |

37.5 |

4% |

|

North America |

127.1 |

39% |

378.8 |

41% |

|

Western Europe |

54.3 |

17% |

159.7 |

17% |

|

Global |

325.3 |

100% |

928.8 |

100% |

Source: Cisco Mobile VNI, 2017

Appendix C: IPv6-Capable Devices, 2016–2021

Table 7 provides the segmentation of IPv6-capable devices by device type, and Table 8 provides regional IPv6-capable forecast details.

Table 7. IPv6-Capable Devices by Device Type, 2016–2021

|

Devices (M) |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

CAGR 2016–2021 |

|

Global |

3,433 |

4,319 |

5,279 |

6,303 |

7,359 |

8,401 |

19.6% |

|

Laptops |

122 |

139 |

152 |

163 |

179 |

192 |

9.4% |

|

M2M |

382 |

564 |

810 |

1,112 |

1,458 |

1,840 |

36.9% |

|

Nonsmartphones |

314 |

361 |

355 |

313 |

294 |

287 |

-1.7% |

|

Other portables |

8 |

6 |

5 |

6 |

7 |

8 |

0.1% |

|

Smartphones |

2,448 |

3,064 |

3,734 |

4,446 |

5,118 |

5,725 |

18.5% |

|

Tablets |

159 |

186 |

222 |

263 |

303 |

348 |

17.0% |

Source: Cisco Mobile VNI, 2017

Table 8. IPv6-Capable Devices by Region, 2016–2021

|

Devices (M) |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

CAGR 2016–2021 |

|

Global |

3,433 |

4,319 |

5,279 |

6,303 |

7,359 |

8,401 |

19.6% |

|

Asia Pacific |

1,645 |

2,105 |

2,572 |

3,080 |

3,603 |

4,118 |

20.1% |

|

Central and Eastern Europe |

369 |

439 |

514 |

592 |

661 |

741 |

15.0% |

|

Latin America |

338 |

408 |

481 |

559 |

643 |

732 |

16.7% |

|

Middle East and Africa |

314 |

459 |

633 |

830 |

1,058 |

1,268 |

32.2% |

|

North America |

345 |

413 |

496 |

575 |

647 |

717 |

15.8% |

|

Western Europe |

423 |

496 |

583 |

667 |

748 |

824 |

14.3% |

Source: Cisco Mobile VNI, 2017